Beat The Bitcoin Blues Part I

The escalating prominence of the Bitcoin virtual currency has gained the attention of the global luxury goods consumer.

Buyers of prestige goods increasingly are drawn to Bitcoin by the allure of rising unit values, aversion to central bank “printing” of conventional currencies, and the growing number of online retailers willing to accept the currency.

300magazine offers the following guidance to those considering Bitcoin; “all that’s pixels is not gold.” In the present Bitcoin market and exchange regime, Bitcoin should not be considered a primary store of value or means of exchange.

The potential for electronic “heists” of Bitcoin hoards, the vulnerability of Bitcoin exchanges, and uncertain government taxation policies undermine the currency’s viability for buyers of luxury goods.

While the precise origins of Bitcoin are the focus of debate and forensic history, January 2009 seems to be the consensus “kickoff” for the virtual currency. Although the concept and early code are attributed to a man named Sakatoshi Nakamoto, “Sakatoshi” may be a pseudonym for an individual or a collaborative effort posing as such.

For the luxury goods consumer, security is the bottom line and ultimate concern. While electronic epics have been written to explain the mechanics of Bitcoin, they are no more relevant at the consumer level than the science of metallurgy or ink technology at government mints.

For the foreseeable future, Bitcoin will not be a reliable store of value or a convenient means of exchange.

The first concern is the security of one’s monetary holdings in Bitcoins, or the lack thereof. While the Bitcoin encryption that identifies known “coins” and the “block chain” record of transactions are considered to be robust, the codes that hold the keys to spending existing Bitcoins can and have been hacked.

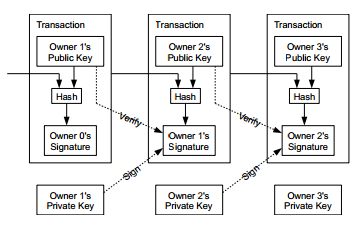

Fundamentally a “Bitcoin” consists of a public transfer record and two codes, one public, one private. The public code is used to derive private code. The basis of “owning” a bit coin is to keep the private code (key) that allows the unit to be spent. A running, open-source public record of transactions called the “block chain” keeps a tally of all Bitcoin transactions, transaction quantities, and destinations.

Since everyone who maintains the chain receives an automatic notice of every validated transaction, anybody who wishes to attempt a crooked “double spend” of Bitcoins would have to alter every single independently maintained copy of the block chain – an impossibility.

However, it is possible for a sophisticated hacker or network of hackers to simply steal the Bitcoin private key codes or “wallets” by infecting known storage databases (personal computers or commercial Bitcoin exhanges) with malware. When this happens, the thieves can transfer the Bitcoins however they please without having to break the key code or alter the impossibly vast record of the block chain; it looks like any other transaction in the view of the computers executing the transfer.

Luxury goods shoppers should note that Bitcoin is not a recognized currency, and there is no deposit insurance regime or government agency to backstop the Bitcoin “exchanges” that store and transfer Bitcoins for account holders. If an exchange is hacked or collapses as a commercial entity, its customers go down with the ship.

Buyers of luxury goods tend to be early adopters of new technology and innovative methodologies. These consumers tend to be the types who are more tolerant of steep learning curves, “public beta test” product quirks, or even financial risk in their investment portfolios. However, acceptance of risk must be predicated on an understanding of risks.

As currently constituted, the Bitcoin economy defies all attempts to calculate risk.

The basic security questions are a concern that should give pause to any individuals considering Bitcoin as a primary means of purchasing luxury goods.

However, those inclined to consider Bitcoin a potential means to circumvent sales tax and/or capital gains taxes may find themselves in the most precarious positions of all.

The tax status of Bitcoin both as an asset and a currency class remains unresolved. Bitcoin is not beyond the scope of regulatory interest or government action. Capital gains tax, income tax, and sales tax can be levied retroactively, and government action concerning Bitcoin taxation is inevitable.

Holders of Bitcoin as a currency or commodity are left waiting for Uncle Sam’s other shoe to drop.

Volatility, illicit activity, and uncertain government tax policies pose incalculable obstacles to those who seek to use Bitcoin as either a means of exchange or a store of value. Each represents one half of the classical definition of money.

Part two of 300magazine’s guide to beating the “Bitcoin Blues” will explore this deficiency in detail.